Insurers receive reports that list residents at your address and will know you have a teenager. However, don’t be surprised if your insurance company asks you about your teen and if he or she is licensed. If your child wants to wait to get a license, that will certainly save you money. Thus, you should contact your car insurance provider before your child gets his or her permit to find out when your current insurer requires you to add your teen driver. However, not all insurance companies follow this guideline some companies require you to add teens and start paying premiums for them once they receive their permit.

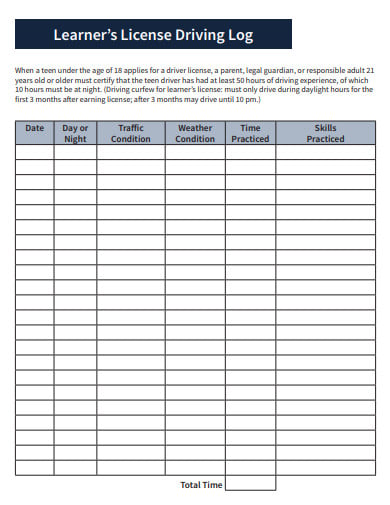

Teen driving log for kansas driver#

At the permit stage, the driver must have a licensed driver over the age of 21 in the passenger seat to supervise, making the teen much less of a risk. Many car insurance companies allow parents to list a teen with a learner’s permit on the policy at no charge until the child becomes a fully licensed driver or turns 18 years of age (whichever is first). Instead, when to add a teen driver varies depending on state laws, as well as your insurance company’s internal guidelines. One of the most common questions from parents of teens is when to add a teenage driver to insurance? There is no standard rule on whether you should add your teen when he or she gets his permit or wait until your child progresses to a license. When to add a teen driver to your auto insurance policy Car insurance rates will go down – eventually.Insurance coverages your teen should have.Excluding a teen driver from parent’s policy.Should a teen get his own policy or go on a parent’s policy?.Saving money on teen car insurance rates.How long do you have to add a new driver to your insurance policy?.Teenage boys are more expensive to insure than girls.The cost of adding a teen driver to car insurance.When to add a teen driver to your auto insurance policy.Also, check if new discounts are available, such as if your child has raised his grades and would now qualify for a good student discount or has taken a driving course. Shop at each renewal, or at least once a year, to make sure your rates are the cheapest possible by comparing the top auto insurance companies.To keep your child safe and insurance rates low (as low as teenage rates can be), monitor your child as a driver and insist on good driving behavior.Remember to ask for discounts with on both.

Add your child at the appropriate time to your current policy or a new insurer with better rates.Shop around and get quotes from other car insurance companies to find the best rates.Get a quote for adding your child to your existing policy with higher liabilities (100/300/100 is recommended).

Teen driving log for kansas license#

Talk to your current insurance company about when you must add your child, whether at the permit stage or when the license is obtained.Continue reading below for additional information on each step. recommends these six steps when adding your teen driver to your policy. Adding a teenager to a car insurance policy is less expensive than putting them on their own policy.You can avail yourself a 5% to 25% discount on your policy if your young driver does well in high school or college.As per ’s analysis, adding your teen to your policy may increase car insurance rates at an average of 161%.Talk to your current insurer to know when you should add a teenager to your car insurance policy.

0 kommentar(er)

0 kommentar(er)